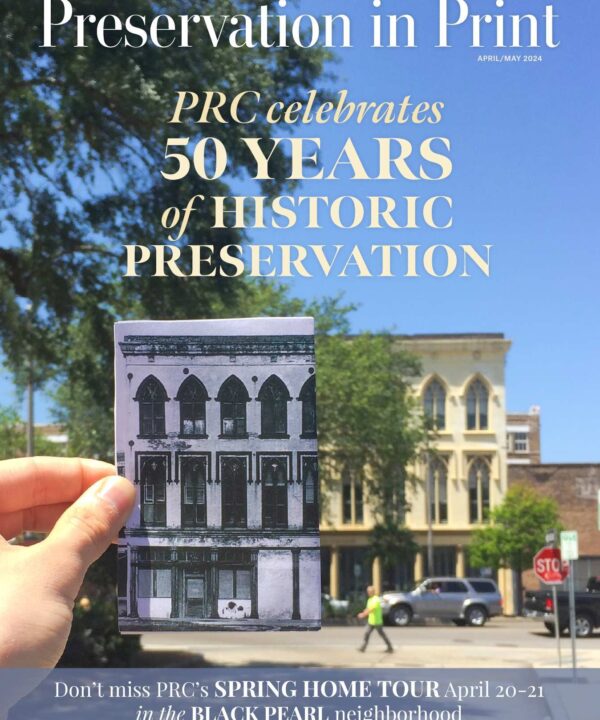

This story appeared in the November issue of PRC’s Preservation in Print magazine. Interested in getting more preservation stories like this delivered to your door nine times a year? Become a member of the PRC for a subscription!

I’m a Preservationist

I’m a Preservationist

S. Parkerson McEnery – Sponsoring broker, McEnery Residential and The McEnery Company

No neighborhood has escaped the COVID 19 pandemic, but the financial fallout is particularly evident along Magazine Street. What is the current state of the real estate market along Magazine?

Remember, the Magazine Street corridor is a roughly 75-block artery that spans the crescent of the river from Audubon Park to Canal Street. There are many sub-markets and neighborhoods along the corridor, and there have, of course, always been sections of Magazine Street more thriving than others. That being said, it is hard to conceive that stock prices have not come down across the board due to the impact of the pandemic. The Amazon effect was already well in motion pre-COVID-19, but recent pandemic-laden impacts clearly already show significantly accelerated trends in favor of e-commerce, an obvious headwind for our coveted Magazine Street retail businesses. In addition to this blow, and perhaps the bigger loss to the corridor since the pandemic, has been the overnight evaporation of the tourism-sourced business that had become a regular demand factor in the business model on Magazine Street. This demand had become especially profound with our seasoned, repeat tourists who had gravitated to the more thriving retail blocks from the Warehouse District to Uptown.

Overall, we are still in a very precarious place on Magazine Street. We hope these recent weeks and months represent a market bottom. The frequency of building trades is way down; and the broad-based perception is that prices are also down.

The market expectation is that prices will continue to fall before they recover; but the X-factor that could move the market back up hinges on the incredibly difficult challenge of handicapping the widespread behavior of local, national and global populations coming out of the pandemic. There are simply too many variables to accurately predict a near-term outcome. But suffice it to say, caution is the order of the day, and optimism takes a lot of work to muster!

We will see a return to normalcy; we just don’t know when. I talk to a lot of business owners, investors and real estate developers, and we discuss their long-term model. I hear everything from 2021 to 2026 on re-stabilization of our local market. Our dependency on tourism has never been more profound than it is today. Our local leadership and city ambassadors have to make return of the tourism industry the top priority once we are out of the woods on the pandemic. The performance of our local leadership and city ambassadors will largely dictate how well and how quickly the market recovers post-pandemic; and in the meantime, it is our obligation as New Orleanians to SHOP LOCAL this holiday season. This last quarter of the year is likely “make or break” for many retailers along Magazine Street. Get out, shop early and often, and be a part of saving local businesses.

Advertisement

Beyond Magazine Street, how are the commercial and residential real estate markets doing across the city?

It is the most extreme example of the most over-used cliché: a Tale of Two Cities.

The local residential real estate market has been white hot, with limited inventory and new price ceilings across the board. We did not see any form of a spring selling season due to the government shutdown; and the pent-up demand to buy has carried through all the way into October.

The increase in time spent at home has propagated a major re-allocation of resources “back to the house.” Homeowners came out of the shutdown with a focused and aggressive plan to change how and where they lived. The reaching for more space is still permeating the market today and combined once again with new lows in interest rates, the recipe for a robust housing market was perfectly mixed. The only headwind remains to be the impact of local economic conditions on the housing sector. So far, any concern related to that on-going narrative has been overcome by strong buyer demand from both locals and a steady trend of new transplants making New Orleans their new pandemic-driven move.

The commercial market, specifically the Central Business District and French Quarter, is a disaster of a situation — specifically a debt disaster. Retail, restaurant, hotel, office and short-term rental properties have all been severely impacted by the loss of tourism, accelerated trends in e-commerce, the Zoom effect on office use and a broad-based drop in physical occupancies in the heart of our city. We simply need people back in the CBD and French Quarter. We need tourists back, and locals need to get back to their offices. There is no replacement for people being physically present in a market, and these huge densities of commercial real estate can only withstand so much physical vacancy.

The debt situation is really problematic. Most of the leveraged commercial real estate deals were underwritten with assumptions that left out the playbook for what to do during a global pandemic. The McEnery Company has launched a loan work-out business, and our phone has started ringing a lot more lately. We are deep into discussions with borrowers and lenders on how to best negotiate a map that gets everyone comfortable with feasible long-term solutions.

There are a few commercial real estate asset classes that remain marketable in today’s climate, but they typically include some component of residential occupancy — including larger-scale multi-family properties. The Uptown multi-family rental property market has been strong of late, with a motivated flight to safety that can also take advantage of the current interest rate climate. The industrial market has also been a safe place to invest, as logistics space needs and storage demands remain strong.

Overall, we are projecting a lot of upcoming change in ownership in the local commercial real estate markets, with some business owners and investors simply unable to hold on for much longer. Outside investment is already taking interest, albeit with requirements for discount off of pre-COVID par values. There will likely be a re-set, attrition, new investment and the eventual re-birth; but the timeline for all of the above is still the greatest variable even the most seasoned real estate investors have ever faced.

Many small retailers along Magazine Street are struggling. Some landlords have given their tenants a break on the rent, while others have not. It’s a difficult situation for everyone involved, as some landlords rely on rental income to pay their own mortgages. Is there any relief that could help break this cycle? What advice do you give to your clients in this situation?

Watching the retailers that continue to get up every day and fight the headwinds with open stores and barely tenable profit margins is inspiring. We have seen numerous tenant defaults along Magazine Street, and like the loan documents, most of the leases do not offer a game plan on how to address the impact of a global pandemic. The answer to this question is: every case is different.

The debt load on the buildings, along with the willingness of the lender to offer reasonable forbearance and long-term debt solutions, will have a lot to do with landlords’ abilities to negotiate more tenable rental structures for our tenant base on Magazine Street.

It’s hard to call any one party the bad guy here, as this really wasn’t anyone’s fault. The situation is different than most other prior crises we have seen in the markets where lenders and investors got greedy and over-extended. The music simply stopped on its own, and we don’t know when it’s going to come back on. The best advice I can offer is to operate in good faith in your business dealings with others right now. One step at a time, and let good faith and best efforts be your guide.

In the meantime, watching Mary Ann and Paul Murphy, the owners of 3701 Magazine St., allow short-term tenants like Elysian (Emily Morrison), Meet Me in Venice (Tanya Becnel) and Marti McEnery’s art studio has been a lot of fun to witness. Supporting these entrepreneurial ladies’ work, as they worked together with the Murphys to breath both rent and business activity back into this amazing building, has been inspiring. I encourage our clients and all building owners along Magazine to allow for similar initial occupancy arrangements — let activity breed activity!

Advertisement

The McEnery Residential office is located in a beautiful two-story Eastlake home at 4901 Magazine St. Tell us about the renovation of that building.

Mike Winters owns our building, and he, along with the general contractor, Mayer Building Company, did a fabulous job restoring what was previously a residential four plex. I started talking to Mike about our building before I knew we were going to move in as his tenant. I tried to talk him into renovating the whole building into offices because I believe in the expansion of demand for Uptown office space. One thing led to another, and out popped McEnery Residential.

We started out leasing just the ground floor of the building, but as McEnery Residential grew, we exercised an option in our lease to expand upstairs, which was originally two apartments. We converted a kitchen to a computer lab, opened a wall, and now the whole building is an office.

It’s really a fabulous building with unique double balconies and a grand gallery on the second floor. 4901 Magazine has some of the most impressive gingerbread in town, and Mayer Building Company did a terrific job restoring it. We are very blessed to work next to the exposed brick and walk on the wide heart of pine. We love our building.

What does historic preservation mean to you, especially in this stressful year?

It’s honestly everything. New Orleans has done a superior job as a city of preserving our historic building inventory and the incredibly unique culture that this inventory creates. New Orleans is a city of buildings, and I think to a large extent, the buildings make us who we are. Our local business leaders and city leadership have historically done a superb job of packaging this culture and selling it across the globe. How we maintain our thoughtful new land development plans as mixed within critical preservation and historic re-development projects will continue to give our leaders the necessary value that the rest of the world has come to love in New Orleans.

One of the few energizing events this year in the local commercial real estate world was the extension of the State Historic Tax Credit. In light of market conditions, this critical incentive is even more necessary going forward. As a local, it is really easy to take this environment for granted; and now more than ever, we have to remember that these buildings are largely what make our people and community unique to the rest of the world. So again, historic preservation is everything this year and going forward.

Advertisements