This story first appeared in the February issue of the PRC’s Preservation in Print magazine. Interested in getting more preservation stories like this delivered to your door each month? Become a member of the PRC for a subscription!

With a republican president and a Republican House and Senate, everyone knew tax reform was a legislative priority in 2017. But no one in the preservation world anticipated what was revealed in the House’s first draft of the tax reform bill: the complete elimination the highly successful Historic Tax Credit.

“We were very surprised,” said Carling Dinkler, Vice President of Business Development for finance firm Enhanced Capital. “The HTC has enjoyed bipartisan support in the past, and it has been seen as effective.” While many see tax credits as handouts, the HTC is a proven moneymaker: according to Dinkler, the credit returns $1.20 to $1.25 back to the federal government for every $1 allocated.

In New Orleans, the threat of the HTC’s elimination was especially alarming. Louisiana is number one in the nation for tax credit projects, and much of that investment is New Orleans-based. It’s no exaggeration to say that the revitalization of New Orleans’ downtown — today a thriving, growing district with near 100 percent residential occupancy — is due primarily to the federal Historic Tax Credit.

The credit, which refunds developers 20 percent of their qualifying rehabilitation expenditures, stacks in Louisiana with the state’s robust 20 percent State Commercial Tax credit to provide an appealing 40 percent credit that developers can utilize as project financing. Those funds are critical to make the preservation of a city’s historic built environment viable — it often costs more to rehabilitate a historic building than build new, according to figures offered by Mackenzie Ledet, Director for Stonehenge Capital, a tax credit finance firm.

Though they work for competing firms, Ledet and Dinkler have joined forces with other prominent financiers, developers and preservation advocates in the past few years to create an informal coalition of historic preservation stakeholders that fights to keep historic tax credits alive on the state and federal level. In a state with perennial budget problems, tax credit programs are continually on the chopping block; this has kept the coalition busy. Nonprofit groups like the Preservation Resource Center, Louisiana Landmarks Society, Preserve Louisiana and the Louisiana Trust for Historic Preservation were natural allies in this effort as well, as were business leaders like HRI Founder and Board Chair Pres Kabacoff. “We joined forces with Ledet and Dinkler to launch grassroots campaigns through social media and email petitions to alert our followers of the damaging impact the loss of the HTC would have on the entire state,” said PRC Advocacy Coordinator Erin Holmes. “Those followers responded by the thousands to let our leaders know the widespread value of the program.”

“Because we have such a strong state credit with strong support by the Lt. Governor and his staff, we already had a coalition organized to hit the ground running,” Ledet said. “We’re a leader nationally [in HTC use], and Louisiana is not a leader nationally in a lot of things, so we had to let our leaders know that the HTC impacts the entire state, and put it on their radars.” The coalition helped arrange a visit for Louisiana Senator Bill Cassidy to The Pythian, a downtown high-rise in New Orleans’ downtown with incredible historic significance for New Orleans and especially its African- American community. Its transformation, from a metal-sheathed, vacant shell to a vibrant mixed-use structure restored to its original glory was still in progress by Green Coast Enterprises and its partners at the time of the visit. “Merrill Hoopengardner, now president of the National Trust Community Investment Corporation, was there too, and a number of us gave [Sen. Cassidy] a tour of The Pythain,” Ledet said. “We just wanted to show him what a significant historic rehab looked like, especially one with a great story. After showing Sen. Cassidy an actual historic rehabilitation project, the coalition made it a priority to meet with him and his phenomenal staff as often as we could. Sen. Cassidy recognized the significant impact of the HTC to the state, and appeared to make it one of his priorities.”

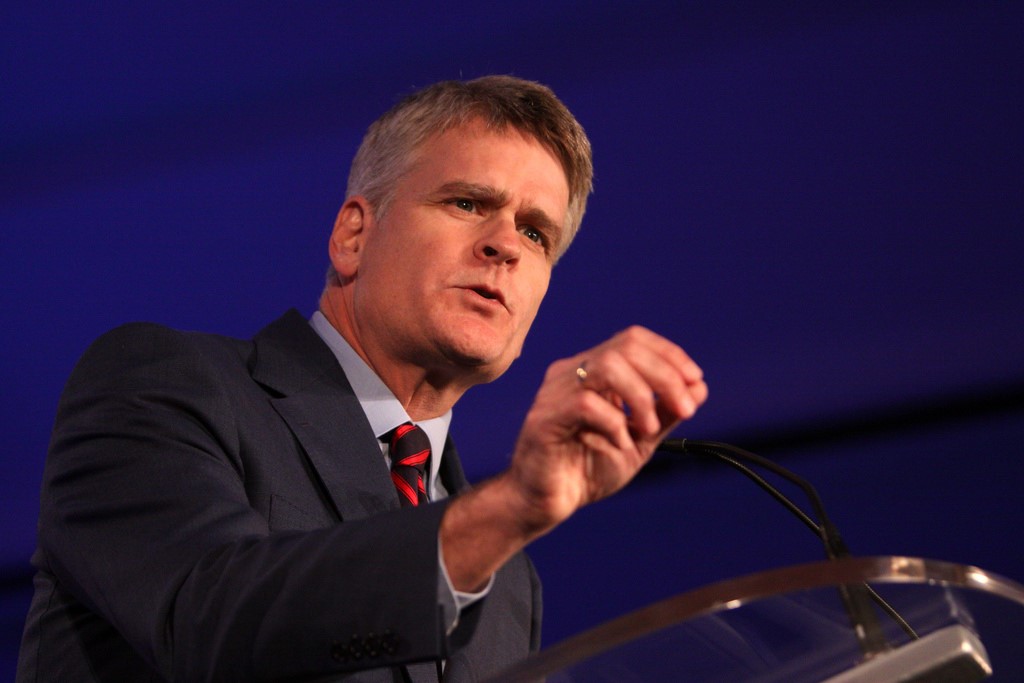

According to Senator Cassidy’s office, many senators on both sides of the aisle were looking for special tax provisions to eliminate in order to lower overall rates. Sen. Cassidy took it upon himself to advocate for the economic impact and revenue that is created by the Historic Tax Credit, and was able to persuade his colleagues on the Senate Finance Committee, which drafted its own tax reform plan. Cassidy made his case repeatedly on the Senate floor, citing the following statistics: More than 40 percent of the projects under the Historic Tax Credit program in the last 15 years have been in towns of less than 25,000 people, essentially making the program a vital tool for small business development; since 2002, the Historic Tax Credit has resulted in $2.5 billion spent on 782 projects in Louisiana, and fostered more than $2.2 billion in private investment, creating more than 38,000 jobs; and according to a National Park Service survey, the Historic Tax Credit has encouraged more than $131 billion in private investment, rehabbing 42,000 buildings, creating more than 2.4 million trade jobs, and returning a net positive to the U.S. Treasury.

Cassidy says he is particularly impressed with the current redevelopment of downtown’s 33-story Mid Century Modern-style World Trade Center building, which is being converted into a Four Seasons Hotel with 336 guest rooms and 80 condominiums, as well as a signature restaurant and 28,000 square feet of meeting space by Massachusetts-based developer Carpenter and Co. and local firm Woodward Design + Build. “What does it bring the city of New Orleans?” Cassidy said. “Four hundred million dollars in infrastructure spending, 1,600 jobs in construction trades, as well as more than 450 permanent full-time jobs. Instead of a crumbling eyesore, you have a jewel. But more than a jewel, you have 1,600 jobs created and 450 permanent jobs.”

While Cassidy’s personal conviction that HTCs benefit Louisiana drove his enthusiasm toward championing their preservation, it was his prominent position on the Senate Finance Committee that was key. It meant he was right there in the room, negotiating various provisions and offsets and working to craft the final product. “It was his goal to have the final bill reflect Louisiana’s needs, and the Historic Tax Credit has had an incredible economic impact for our state,” said Cassidy spokesman Ty Bofferding.

It wasn’t an easy goal to achieve. When the House passed its bill eliminating the credits, Cassidy knew he needed to build a coalition of allies in the Senate. A natural fit was fellow Louisiana Senator John Kennedy; others included Iowa Republican Sen. Chuck Grassley, Georgia Republican Sen. Johnny Isakson and South Carolina Republican Sen. Tim Scott. Cassidy’s appeals to Senate Finance Committee Chairman Orrin Hatch were successful in getting the Historic Tax Credit reinserted into the Senate’s version of the legislation — but at a reduced rate of 10 percent.

At that point, Cassidy put together a carefully crafted compromise reflecting immense input from constituents in Louisiana, his office said. With help from Louisiana Representative Steve Scalise in the House, Cassidy led the charge to preserve the credit at the 20 percent rate. Without Cassidy’s efforts, many say that elimination of the HTC would have been certain. “There is no doubt that eliminating the credit would have had a severe and negative impact on the redevelopment of historic buildings in New Orleans and all of Louisiana,” Dinkler said. “The credit really provides the ability for a developer to go in and bring a building back to its former glory. If you look at economics of a restoration project, the credit is such a critical component to making it work. And developers have to follow certain standards, and that’s a good thing, making sure buildings are restored using a set of rigorous standards. If the credit had gone away or been cut in half, we would have seen a slowing of a lot of great work that has been accomplished.”

It is with all this in mind, and with extreme gratitude towards the hard work Senator Cassidy did to protect the HTC, that the board of the Preservation Resource Center moved to establish a new annual award, the PRC Preservation Policy Leadership Award, and make its inaugural recipient Senator Bill Cassidy. We thank Senator Cassidy for leading this effort, and look forward to seeing more good work in the future as he continues to protect the interests that benefit the residents of Louisiana, including the Historic Tax Credit. As Cassidy himself said on the Senate floor after the bill was ratified, “The Historic Tax Credit … allows somebody to go to an older building in a community and to restore it, returning it to commerce, so instead of a portion of our architectural heritage being destroyed, it is refurbished and it is there for future generations to enjoy. It is more than the aesthetics of seeing an older building become beautiful once more. It creates jobs…jobs for working families and middle-income families.”