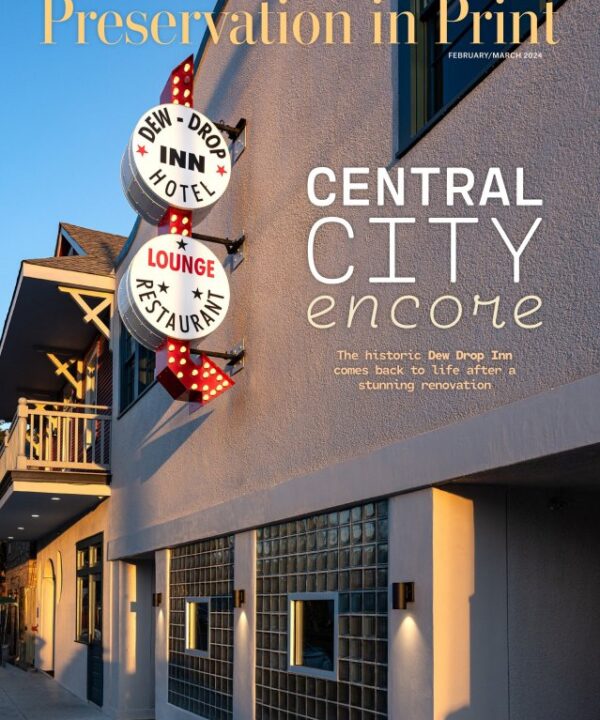

This story appeared in the October issue of PRC’s Preservation in Print magazine. Interested in getting more preservation stories like this delivered to your door? Become a member of the PRC for a subscription!

I’m a Preservationist

I’m a Preservationist

Todd McDonald

President, Liberty Bank

Congratulations on being named president of Liberty Bank and taking the reins from your father, Alden McDonald Jr., who led the bank for 50 years. Based in New Orleans, Liberty is the largest African American-owned bank in the nation and the only Black-owned bank with assets of more than $1 billion. Since the bank’s founding in 1972, Liberty’s mission has been to provide financial services to people of all backgrounds, especially in underserved communities. What are you hearing from the bank’s clients today about the challenges they face in this topsy-turvy economy?

Generally, Liberty Bank’s small business customers are rethinking plans for expansion and are very conservative in their outreach for credit currently. There has been an across-the-board reduction in lending due to higher interest rates, and many businesses still struggle to hire topnotch talent. The good part about this slowdown is that it is allowing businesses to focus on their core operations and strengthening their balance sheets for the uncertainty ahead. Once the country is on the other side of this market shift, businesses should have a lot of clarity on how to grow and what levers to pull to accomplish financial goals.

Home prices have increased dramatically in the New Orleans metro area over the past few years, which has built generational wealth for longtime homeowners but has also made it difficult for first-time homebuyers. What is your outlook for the local real estate market?

The local real estate market has cooled considerably, but there is still plenty of interest from people looking to relocate here. New Orleans real estate properties are much cheaper than the Texas and Georgia markets. Potential first-time homebuyers face both increased interest rates but also quickly climbing insurance costs exacerbated by new federal legislation. Liberty continues to offer a range of options to provide the opportunity for many to own homes. Liberty is participating in several soft second programs, reducing down payment requirements, and exploring non-traditional ways of underwriting. We also are working with developers to build more affordable housing for our local citizens. While there has been some pull back on house sales, there still is moderate demand based on the comparative real estate prices in the State of Louisiana. Local homebuyers face big challenges.

New Orleans is a city of historic neighborhoods, where the culture and architecture are such a deep part of our city’s identity. Where did you grow up and did your neighborhood have any influence on your approach to banking today?

I grew up in New Orleans East. My family home was destroyed during the flooding when the levees broke following Hurricane Katrina. My views on preservation are rooted in the resilient nature of New Orleans. We should preserve the things that make New Orleans unique, but we should always be ready to innovate to sustain our way of life.

Where do you live now?

I live in a historic house in the Lower Garden District, and I have the responsibility of upkeep on that property based on historic district guidelines. While I believe our city must preserve and highlight the unique architecture and our unique culture, we have to approach preservation with an open mind to affordable options that allow our current citizens to live in the historic properties they own and can pass them on to future generations of New Orleans citizens.

Advertisements