This story appeared in the August/September issue of PRC’s Preservation in Print magazine. Interested in getting more preservation stories like this delivered to your door? Become a member of the PRC for a subscription!

By Nicole Hobson-Morris, Executive Director of the Division of Historic Preservation

The recent 2023 regular session of the Louisiana Legislature resulted in some positive amendments to the highly utilized State Commercial Tax Credit Program. Effective Aug. 1, Act 426 provides for the following:

- The program now sunsets on Dec. 31, 2028.

- Property owners of individually listed and contributing resources to a National Register Historic District are now eligible to apply.

- Eligible expenses incurred after Jan. 1, may receive a 25 percent tax credit.

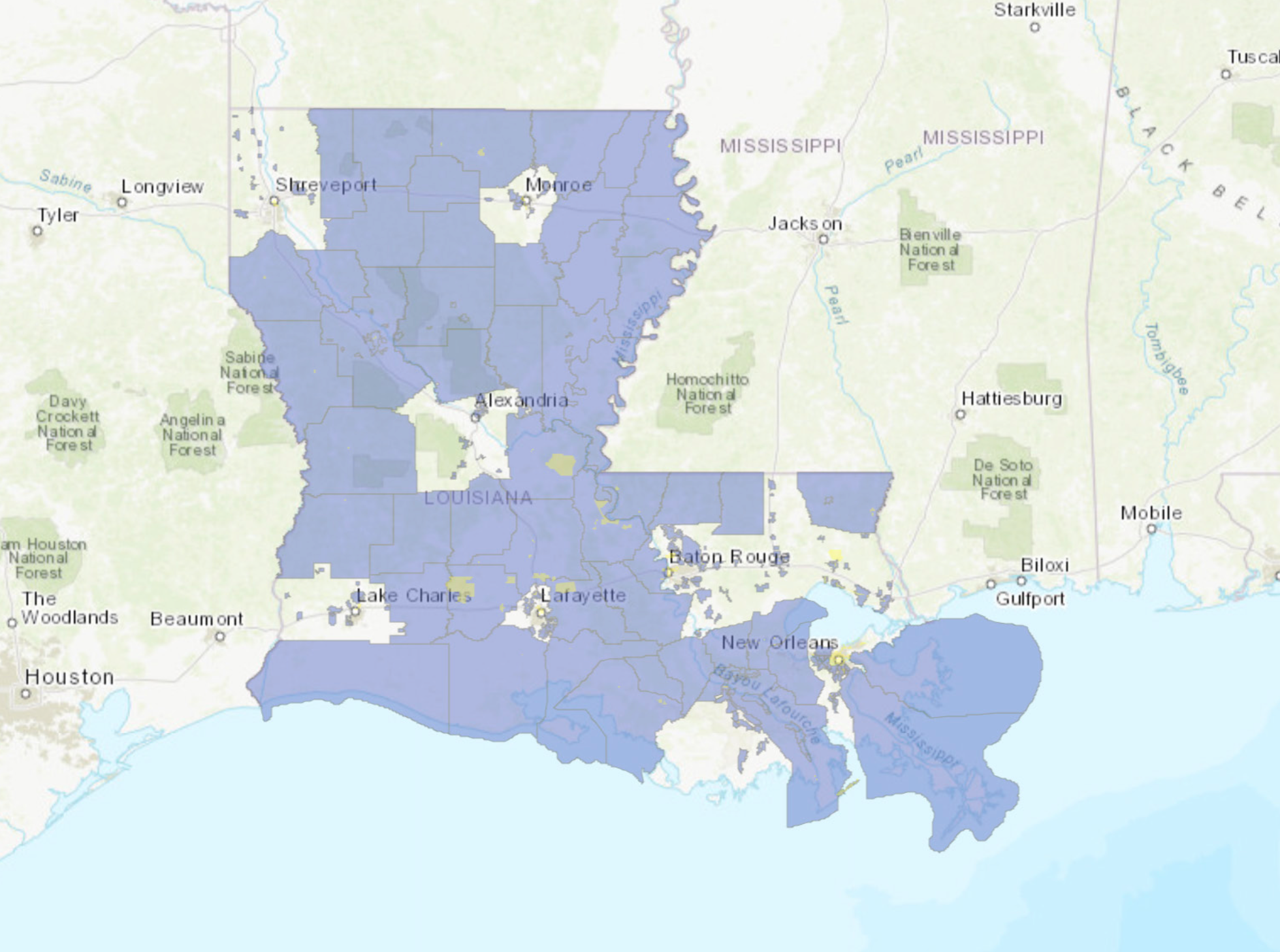

- Properties located within an area defined as rural, may receive a 35 percent tax credit. The legislation uses the most recent decennial census data to define rural as:

-

- A parish with a population of less than 100,000

- A municipality with a population of less than 35,000

- An unincorporated area of a parish with a population of 100,000 or more.

A property may fall outside the census boundary for a rural municipality or unincorporated area but still qualify as rural if the address indicates its inclusion in a qualifying municipality or unincorporated area. Our tax incentives map showing rural areas in our state may be accessed here.

As a result of these changes, the Louisiana Division of Historic Preservation has issued new State Commercial Tax Credit applications, which became available on July 24 on the Tax Incentives website here. Older versions of the application forms will no longer be accepted after Oct. 30.

We are going digital

DHP will begin accepting digital State and Federal tax credit applications beginning Aug. 1 via a Google form. To submit forms electronically via this application, applicants must create a free Google account with a Gmail address. Applicants who cannot do so may submit digital applications via a mailed USB drive. Additional submission guidance is posted on the Tax Incentives website. State tax credit projects not pursuing federal certification may still be submitted in hard copy until Oct. 30.

We encourage you to check the Tax Incentives update page in the coming weeks for updates on the new application forms and electronic submission of applications. Questions about State Commercial Tax Credit application changes may be addressed to taxincentives@crt.la.gov.

Federal Tax Credits

As of Aug. 15, all federal historic preservation certification applications must be submitted electronically, both new applications submitted to State Historic Preservation Offices (SHPOs) and materials submitted to the NPS in response to requests for additional information. Technical Preservation Services has issued new application forms and instructions that are now available on the TPS website here.

Older versions of the federal applications will no longer be accepted after the Aug. 15 deadline.

TPS has developed file- and photo-naming conventions and guidance on organizing files for submission. All electronically submitted applications must follow these conventions and guidance. Additional information about that process is provided below.

NPS has scheduled a training webinar for Wednesday, Aug. 8 at 4 p.m. on electronic submission for program users. Register here.

Transition period FAQs

How will the transition period work?

All applications submitted to a SHPO or to the NPS on or after Aug. 15 must be on the newly revised 2023 application forms. For the NPS and any SHPOs accepting applications electronically ahead of that deadline, the applications must also be on the new form. Older forms will not be accepted electronically by SHPOs or by the NPS.

The NPS will begin accepting applications electronically (i.e., for applications placed on hold for additional information) as soon as the new application form is issued. The NPS will continue to accept hard-copy submittals until Aug. 14. Any applications submitted on or after Aug. 15 must be submitted electronically.

What happens to applications submitted in hard copy that are still under review by the SHPO or the NPS at the time of the Aug. 15 deadline?

Applicants will not be required to resubmit applications electronically after the Aug. 15 deadline if the application was submitted to the SHPO or the NPS prior to the deadline and review of the application is still in process. For example, if an application was submitted prior to the deadline and later put on hold for more information, and the applicant submits the additional information after the deadline, the additional information must be in the electronic format. The original application and submittals would remain hard copy but any subsequently submitted information after the deadline must be in electronic format.

How will applications be submitted electronically to the NPS?

SHPOs will forward reviewed applications to the NPS via a Sharepoint portal developed by NPS. When NPS puts an application on hold and requests additional information, the applicant and project contact will be notified by email to submit that information through the portal, with a copy sent to the SHPO concurrently using the SHPO’s electronic-submission process.

Instructions for submitting information will be included in the NPS email. The applicant and project contact will be emailed a link to a project-specific electronic folder in the Sharepoint portal for one-time use. Once the information has been uploaded by the applicant and the intake completed by the NPS, the files will be moved out of the folder and the folder will be deleted.

Other amendments will continue to be submitted directly to the SHPO as usual, and the SHPO will forward the applications to the NPS after their review has been completed.

What types of e-signatures will be accepted?

Three types of electronic signatures (e-signatures) will be accepted:

-

- a scanned PDF of an actual, original wet-signed application

- a scanned or digitized version of an actual, original handwritten signature

- a digital signature using a digital ID (e.g., using Adobe software). A name typed in a different font and other types of generated signature images will not be accepted. Questions about the electronic submission requirements may be addressed to NPS_TPS@nps.gov.

The Louisiana Office of Cultural Development’s Division of Historic Preservation is located within the Department of Culture, Recreation & Tourism under the direction of Lieutenant Governor Billy Nungesser. Visit www.Louisianahp.org for information about the Tax Incentives Program, as well as all other programs administered by the Division.