In downtown Gretna, St. Joseph Church, built in 1926, was recently repaired to fix critical water damage. The restoration of this beautiful Spanish Colonial Revival-style structure — which annually hosts one of the largest St. Joseph’s Altars in the New Orleans area — was made possible with help from Louisiana’s Historic Rehabilitation Commercial Tax Credit Program.

In downtown Covington, the Southern Hotel laid dormant for many years until a local preservationist breathed life back into the landmark. That project, too, was made possible thanks in part to Louisiana’s Historic Rehabilitation Commercial Tax Credit Program.

Across Louisiana, thousands of formerly blighted, vacant or damaged buildings have been saved and renovated to serve the community, thanks to the state’s tax credit for the restoration of historic structures.

Now this vital economic development tool — and the thousands of jobs it creates across the state — is in jeopardy. The Louisiana Legislature is considering a cap on the amount of credit available, putting many building projects into limbo right when these jobs are needed the most as the state recovers from the COVID 19 shutdown.

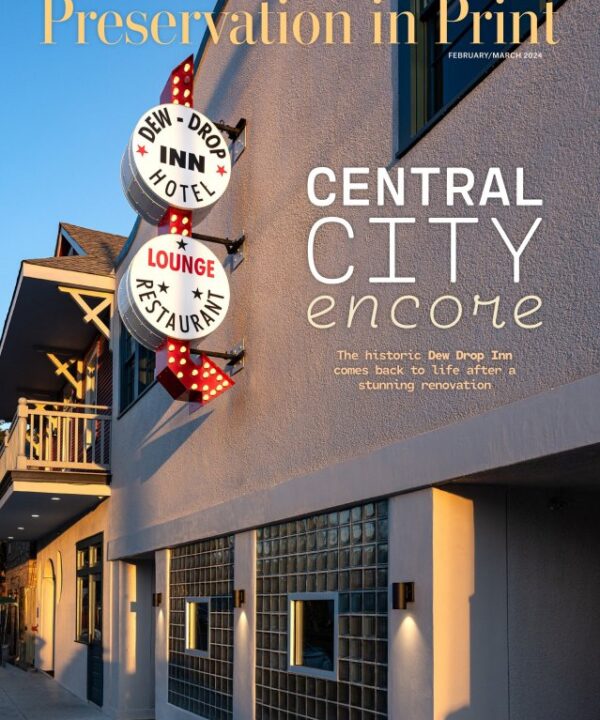

“As a small scale developer who has utilized the state commercial tax credit for 15 projects in the last seven years, the reduction and capping of the historic tax credit will have devastating consequences for reducing blight and preserving our rich architectural heritage,” said local developer Peter Gardner, who restored the long-vacant former St. Francis de Sales Church in New Orleans’ Central City neighborhood last year as one of his many projects. “This tax credit has allowed marginal rehabilitation projects to become viable, while creating jobs, and contributing positively to our tax base for many years. This reduction will cause a net job loss at a time when keeping and growing employment is critical in our state.”

For those who care about historic preservation and want to see blighted buildings restored, now is the time to act. Please contact your legislators today and tell them to SAVE THE HISTORIC TAX CREDIT PROGRAM! Scroll down for ways to take action.

Louisiana’s Historic Rehabilitation Commercial Tax Credit has attracted billions of dollars in investments from developers around the world. The program is so successful that it has been replicated in other states, including Texas.

But recent amendments placed on the tax credit’s renewal would severely limit the economic development brought by this program. In an effort to balance the state budget, Louisiana legislators are smartly taking a hard look at tax credit programs. Here are the facts about how Louisiana’s Historic Rehabilitation Tax Credit drives money back into our economy:

Since 2002, the tax credit has led to the rehabilitation of 1,322 buildings across Louisiana, triggering more than $4 billion in private investment in the state’s historic downtowns and cultural districts.

Half of all projects receiving the credit were smaller than $500,000 in total costs, demonstrating that the credit is fundamentally a small business incentive.

Please ACT NOW. Contact your Louisiana legislators and then call your friends and ask them to act, too.

HERE’S HOW TO ACT NOW

Follow THIS LINK to find your state legislators, and email them a message in support of Louisiana’s Historic Rehabilitation Tax Credit Program. You can copy and use ours:

Subject: Please Support Louisiana’s Historic Rehabilitation Commercial Tax Credit Program

Dear [elected official],

Please support the renewal of Louisiana’s Historic Rehabilitation Commercial Tax Credit without an unnecessary “back end cap.” Limiting the number of credits that can be redeemed in a given year after credits have been promised and work approved will deter investors and stall projects.

The program, often referred to simply as the State Historic Tax Credit, has restored more than 1,300 buildings and unleashed combined investments of almost $4 billion in Louisiana since 2003. Those buildings, many of which were blighted and vacant, are now home to thriving businesses. Some are hotels, others provide workforce housing, while others hold churches or schools. Thirty parishes now benefit from the increased property values and ad valorem taxes that result.

Perhaps most importantly, the return on investment to the state of Louisiana is approximately $3 for every $1 in credits issued. A 2011 study by Dr. Timothy Ryan put the figure at $3.22 inclusive of local sales taxes. A 2015 study by Novgradic put the state’s share at $2.77. A 2017 study by PlaceEconomics calculated the net economic activity at $8.70 for each $1 in credits.

Every building rehabilitation creates real jobs for Louisiana plumbers, electricians and carpenters. Every project requires the purchase of lumber, bricks, paint and other materials. The resulting income and sales taxes make it easier to balance the state’s budget in the future. We can’t afford to turn our backs on this economic development program now.

Please support the extension of the Historic Tax Credit without cuts, caps and limits.

Sincerely,

[your name]